nys workers comp taxes

Get information about the benefits available under workers compensation including medical care lost wages and benefits for survivors. You may also contact the Task Force weekdays at 518 485-2144 between 8 am and 4 pm or send us an e-mail.

View From The Burj Khalifa In Dubai Uae Burj Khalifa Dubai Views

A business must have an active NYSIF workers comp policy have more workers comp premium or payroll in New York State than in all other states combined and will be subject to NYSIF underwriting review to be eligible for NYSIFs out-of-state coverage.

. For further information you may. Visit Department of Labor for your unemployment Form 1099-G. The franchise tax based on premiums also is referred to as premium tax.

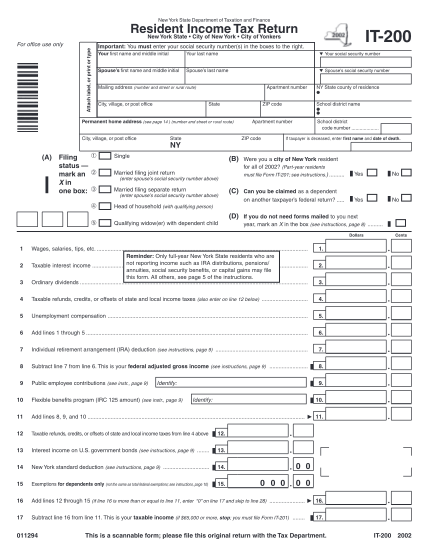

Do you claim workers comp on taxes the answer is no. Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in the claim process. If you withhold New York State New York City or Yonkers income tax from your employees wages you must report it quarterly on Form NYS-45.

Household employers in New York with full-time employees 40 hoursweek or a live-in employee are required to get coverage for workers compensation insurance. This tax exempt status applies if the worker receives these benefits under a workers compensation act or law. I have a nys workers compensation form c-8 my lawyer says i will use this when i do my taxes.

If you withhold less than 700 during a calendar quarter pay the tax with your Form NYS-45. While a worker does need to report these benefits on New York tax form W-2 Wage and Tax Statements the amount awarded by the New York State Workers Compensation Board is excluded from. Get information on medical benefits and help finding a provider.

Workers comp benefits are non-taxable insurance settlements. You may need to report this information on your 2021 federal income tax return. The IRS in Publication 907 specifically states that workers compensation benefits for job-related sicknesses or injuries are not taxable.

Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income. According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. We use cookies to give you the best possible experience on our website.

Workers Comp Exemptions in New York. However retirement plan benefits are taxable if either of these apply. Building 12 - Room 282.

Is workers comp taxable in NYS for either State or Federal. Workers Compensation Workers Compensation Benefits. NYSIF expects to begin to offer out-of-state coverage beginning in the summer of 2022.

Get Form 1099-G for tax refunds. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. The quick answer is that generally workers compensation benefits are not taxable.

New York State Department of Labor. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Workers compensation benefits for work injuries are tax-exempt if they are paid under the workers compensation act and also includes the survivors that receive benefits for fatal injuries.

Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. In most cases they wont pay taxes on workers comp benefits. New York is a Loss Cost state which means that the NY Rating Board issues new manual rates for workers compensation each year Usually around October 1.

The workers compensation system in NY is administered by NYCIRB. Partners and LLC must be included at a minimum of 35100 and a maximum of 106600. Also under IRS regulations non-taxable workers compensation-related benefits are not eligible for salary deferral under the New York State Deferred Compensation Plan NYSDCP.

He said my tax professional will know where this goes. Amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act or a statute in the nature of a workers compensation act. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

If you received an income tax refund from us for tax year 2020 view and print New York States Form 1099-G on our website. Or you can complete the Tip Sheet. Typically in New York workers that receive benefits from workers compensation due to an on the job injury are not subjected to taxes at the federal state or local levels.

Workers compensation disability insurance and paid family leave. Home Tax Resources Recent Articles What NY Employers Need to Know About Workers Comp and Disability. However Workers Compensation 1084 exempts the surcharge that insurers charge their insureds as recoupment for amounts paid into the fund from such taxation.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. - Answered by a verified Tax Professional. You are responsible to pay the amount you withhold to the Tax Department as follows.

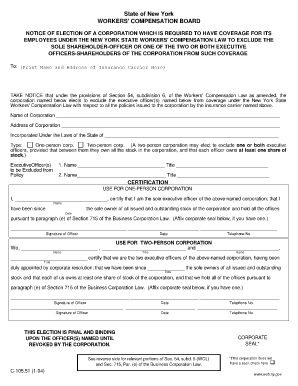

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of 114400 for rating their overall workers compensation cost. Employers must post a notice of workers compensation coverage Form C-105 obtained from their workers compensation carrier. Harriman State Office Campus.

Liability and Determination Fraud Unit. Workers compensation benefits are not considered taxable income at the federal state and local levels. Thus the Workers Compensation Security Fund surcharge is not subject to premium tax.

As a small business owner you may think that youre exempt from workers comp and disability insurancebut you are not if you have any type of employee. NY Rates are currently about 155 higher than the national median. Household employers in New York must provide workers compensation to household employees who work 40 or more hours per week.

I want to do my own taxes so i was wondering if someone could tell me what line to put the amount from the c-8 form. You retire due to your occupational sickness. Overview When the Workers Compensation Board issues an award of compensation for a prior year disability period and any portion of the award is credited to NYS the State Insurance Fund sends a C8EMP Info form to OSC.

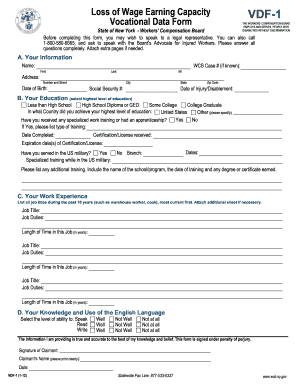

22 Printable Nys Workers Compensation Forms Templates Fillable Samples In Pdf Word To Download Pdffiller

Self Employed Vs Small Business Owner How Status Affects Your Profit Business Tax Deductions Small Business Owner Business Tax

New York City Skyscraper Willis Tower

Nys Workers Compensation Forms Fill Out And Sign Printable Pdf Template Signnow

The Complete Guide Of 100 New York Workers Compensation Faqs

Workers Compensation Governor S Office Of Employee Relations

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller

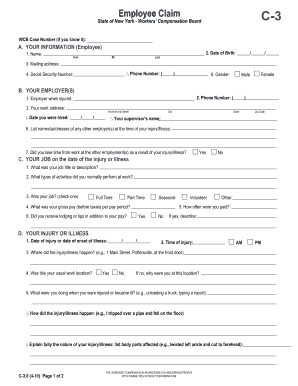

Ce 200 Apply Workers Compensation Board New York State

The Mileage New York State Workers Compensation Board Facebook

21 Nys Workers Compensation Exemption Form Free To Edit Download Print Cocodoc

New York State Workers Compensation Law Annotated Lexisnexis Store

Nys Workers Compensation Future Medical Settlements Paul Giannetti

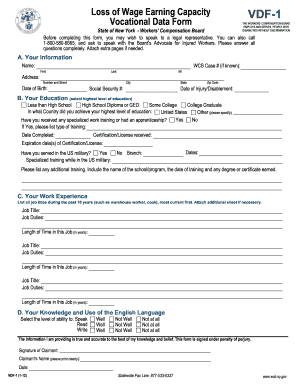

Ny Workers Compensation C 3 Form Injury Attorney

Ny Workers Comp Max Settlement Amounts Paul Giannetti Attorney At Law

21 Printable Nys Workers Compensation Forms C 4 Templates Fillable Samples In Pdf Word To Download Pdffiller